Indices

Overview

Bursa Malaysia and FTSE Group joined forces on 26 June 2006 to launch the market data.

The market data is designed to represent the performance of companies, providing investors with a comprehensive and complementary set of indices, which measure the performance of the major capital and industry segments of the Malaysian and regional market.

All Malaysian companies listed on the Bursa Malaysia Main Market and ACE Market are eligible for inclusion, subject to meeting FTSE's international standards of free float, liquidity and investability. The FTSE Bursa Malaysia index methodology allows investors to do cross border analysis and comparison while a set of Ground Rules provides transparency to the management of the index series.

The index series covers all stock sizes within the market and provides the investors with a better tool to benchmark their investments. The indices are also suitable for the creation of investment products such as ETFs, derivatives, structured products and index tracking funds.

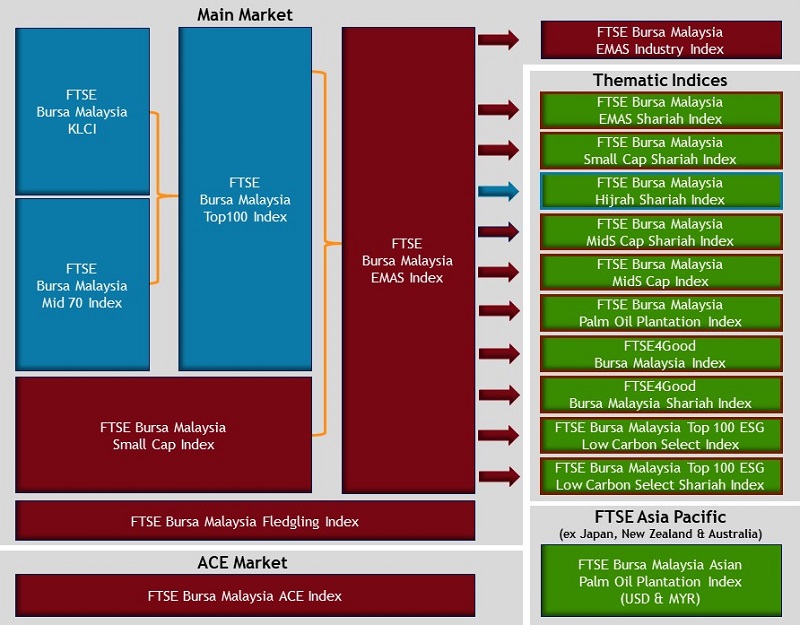

List of FTSE BM Indices

Tradable Indices

- FTSE Bursa Malaysia KLCI Index

Bursa Malaysia and FTSE Group introduced enhancements to the Kuala Lumpur Composite Index (KLCI) on 6 July 2009. Find out more about the FTSE Bursa Malaysia KLCI here.

This tradable index comprises the 30 largest companies in the FTSE Bursa Malaysia EMAS index by market capitalisation. - FTSE Bursa Malaysia Mid 70 Index

Comprises the next 70 companies in the FTSE Bursa Malaysia EMAS Index by full market capitalisation.

- FTSE Bursa Malaysia Top 100 Index

Comprises the constituents of the FTSE Bursa Malaysia KLCI and the FTSE Bursa Malaysia Mid 70 Index.

- FTSE Bursa Malaysia Hijrah Shariah Index

The FTSE Bursa Malaysia Hijrah Shariah Index is a tradable index which comprises the 30 largest companies in the FBM EMAS Index that meets the following triple screening process:

- FTSE's global standards of free float, liquidity and investability.

- Yasaar's international Shariah screening methodology.

- Malaysian Securities Commission's Shariah Advisory Council (SAC) screening methodology.

- FTSE Bursa Malaysia Asian Palm Oil Plantation Index (USD and MYR)

This index comprises the companies from the universes of developed, advanced emerging and secondary emerging countries as classified by FTSE in the Asia Pacific region excluding Japan, Australia and New Zealand that derive substantial revenue from palm oil activities.

Benchmark Indices

- FTSE Bursa Malaysia EMAS Index

Comprises the constituents of the FTSE Bursa Malaysia Top 100 Index and FTSE Bursa Malaysia Small Cap Index.

- FTSE Bursa Malaysia MidS Cap Index

Comprises constituents from the FTSE Bursa Malaysia EMAS Index with full market capitalisation between MYR200 million and less than MYR2 billion.

- FTSE Bursa Malaysia Small Cap Index

Comprises those eligible companies within the top 98% of the Bursa Malaysia Main Market excluding constituents of the FTSE Bursa Malaysia Top 100 Index.

- FTSE Bursa Malaysia Fledgling Index

This index comprises the Main Market companies which meet stated eligibility requirements, but are not in the top 98% by full market capitalisation and are not constituents of the FTSE Bursa Malaysia EMAS Index. No liquidity screening is applied.

- FTSE Bursa Malaysia EMAS Shariah Index

The FTSE Bursa Malaysia EMAS Shariah Index comprises constituents of the FTSE Bursa Malaysia EMAS index that are Shariah-compliant according to the Securities Commission's SAC screening methodology and FTSE's screens of free float, liquidity and investability.

The index has been designed to provide investors with a broad benchmark for Shariah-compliant investment.

- FTSE Bursa Malaysia MidS Cap Shariah Index

Consists of all constituents of the FTSE Bursa Malaysia MidS Cap Index that are Shariah compliant according to the SAC screening methodology.

- FTSE Bursa Malaysia Small Cap Shariah Index

This index comprises the constituents of the FTSE Bursa Malaysia Small Cap Index that are Shariah compliant according to the Securities Commission’s Shariah Advisory Council (SAC) screening methodology.

- FTSE Bursa Malaysia ACE Index

The FTSE Bursa Malaysia ACE Index comprises all eligible companies listed on the ACE Market. No liquidity screening is applied.

- FTSE Bursa Malaysia Palm Oil Plantation Index

This index comprises the constituents of the FTSE Bursa Malaysia EMAS Index that derive substantial revenue from palm oil activities that meet the stated eligibility requirements.

- FTSE Bursa Malaysia EMAS Industry Indices

The indices comprise the constituents of the FTSE Bursa Malaysia EMAS Indes and are categorised into 10 industry, 19 supersector, and 39 sector indices.

- FTSE4Good Bursa Malaysia Index

- Please visit our F4GBM Index page for more information on methodology and ESG Ratings

- FTSE4Good Bursa Malaysia Shariah Index

Comprises constituents of the FTSE4Good Bursa Malaysia index that are Shariah-compliant according to the Securities Commission’s SAC screening methodology.

- FTSE Bursa Malaysia Top 100 ESG Low Carbon Select Index

The Index comprises constituents of the FTSE Bursa Malaysia Top 100 Index and targets 30% reduction in index level carbon emissions, 30% reduction in fossil fuel reserves and 20% improvement in index level ESG ratings. Product and conduct-related exclusions are applied to the Index.

- FTSE Bursa Malaysia Top 100 ESG Low Carbon Select Shariah Index

The Index consists of all constituents of the FTSE Bursa Malaysia Top 100 ESG Low Carbon Select Index that are Shariah compliant according to the Securities Commission’s Shariah Advisory Council (SAC) screening methodology.