Indices

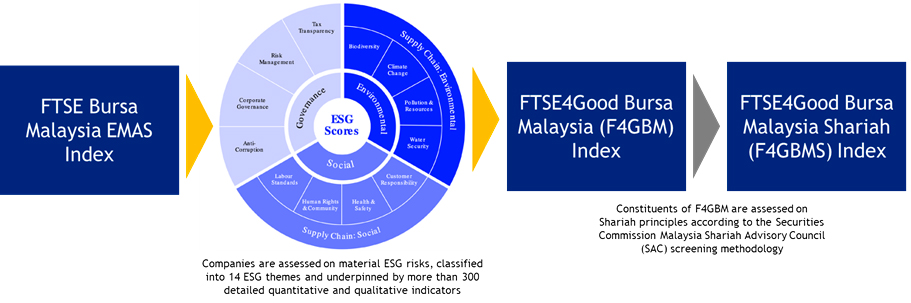

FTSE4Good Bursa Malaysia (F4GBM) Index

Environment, Social and Governance (ESG) criteria is increasingly becoming an important part of investment and risk management decision process. Launched in December 2014, the F4GBM Index is aimed to:

• Support investors in making ESG investments in Malaysian listed companies;

• Increase the profile and exposure of companies with leading ESG practices;

• Encourage best practice disclosure; and

• Support the transition to a lower carbon and more sustainable economy.

In July 2021, Bursa Malaysia and FTSE Russell launched the FTSE4Good Bursa Malaysia Shariah (F4GBMS) Index to cater to investor demand for ESG and Shariah-compliant index solutions. The F4GBMS index is designed to track constituents in the F4GBM Index that are Shariah-compliant.

Selection Methodology:The composition of the F4GBM and F4GBMS indices are reviewed semi-annually in June and December. For the latest list of inclusion and deletion, please refer to here.

For more information on F4GBM ESG model, please refer to here.

Further information is available on FTSE4Good’s website.

ESG Ratings:

As part of the continuous efforts to promote and encourage the adoption of ESG practices in the marketplace, Bursa Malaysia, in collaboration with FTSE Russell has made available the ESG scores of Malaysian public listed companies.

The ratings can be assessed here.

FAQ on the FTSE4Good ESG Ratings can be assessed here.

For further information on the development of ESG, please visit BURSASUSTAIN.